Brindisi: ‘Super Wealthy’ Don’t Need $100B Tax Cut from Capital Gains Adjustment

Congressional candidate Anthony Brindisi says the 'super wealthy' don't need a $100-billion tax cut.

The Utica Democrat held a press conference Wednesday outside of the North Utica Walmart location to raise two issues. First, he says an uptick in inflation will mean consumers will be paying more for everyday goods like paper towels, tissues, soap, toothpaste and more starting this fall.

Any benefit from the Trump tax cuts will be soaked up by these price increases, he says.

Additionally, Brindisi is calling for congressional hearings to stop the Treasury Department from making a move that would amount to a $100 billion tax cut for the rich. By changing the definition of 'cost' and allowing taxpayers to adjust the value of an asset to today's inflation adjusted value, he says.

MarketWatch.com explained it this way in a recent article:

Capital gains taxes are determined by subtracting the original price of an asset from the price at which it was sold and taxing the difference, usually at 20 percent.

If someone spent $100,000 on a stock in 1980 and sold it for $1 million today, he or she would owe taxes on $900,000.

But if the original purchase price was adjusted for inflation, it would be about $300,000, reducing the taxable gain to $700,000, saving the investor $40,000.

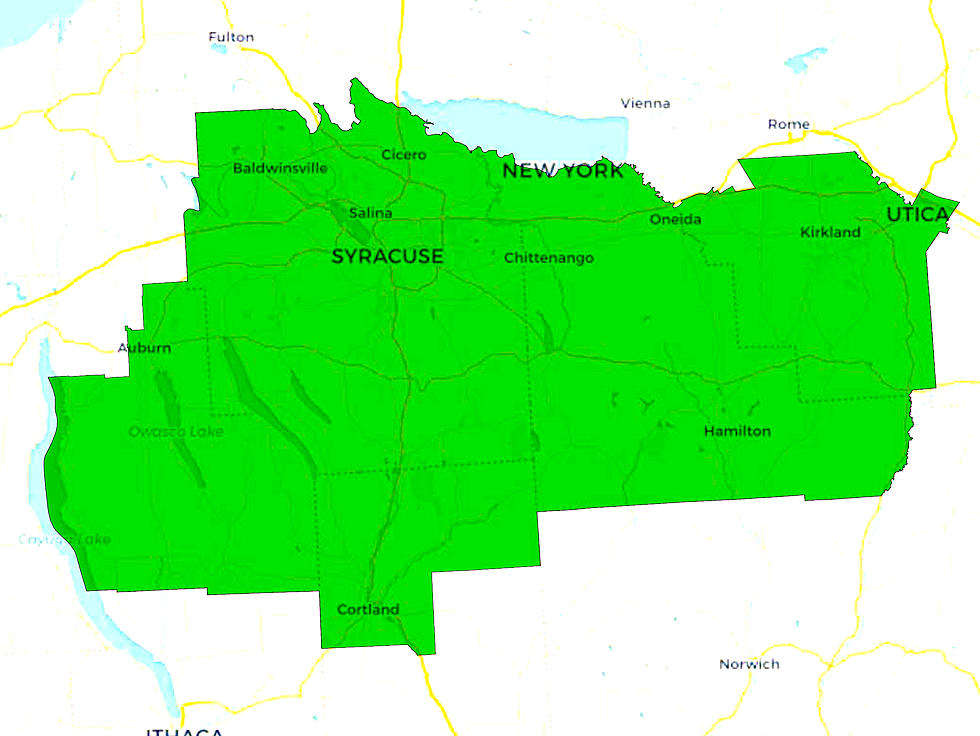

Brindisi is challenging incumbent NY-22 Republican Claudia Tenney this fall. He says as a member of the House Financial Services Committee, Tenney should be demanding action to stop the change.

When asked for comment, Tenney's campaign sent this response:

“While Claudia Tenney has fought to cut middle class taxes and the economy is turning around, Anthony Brindisi is a total phony who cheerleads against the economic turnaround and traffics in lies and scare tactics to distract from his votes to help corrupt Governor Cuomo and felon Sheldon Silver give middle class families the highest tax burden in the nation.”- Raychel Renna

More From WIBX 950